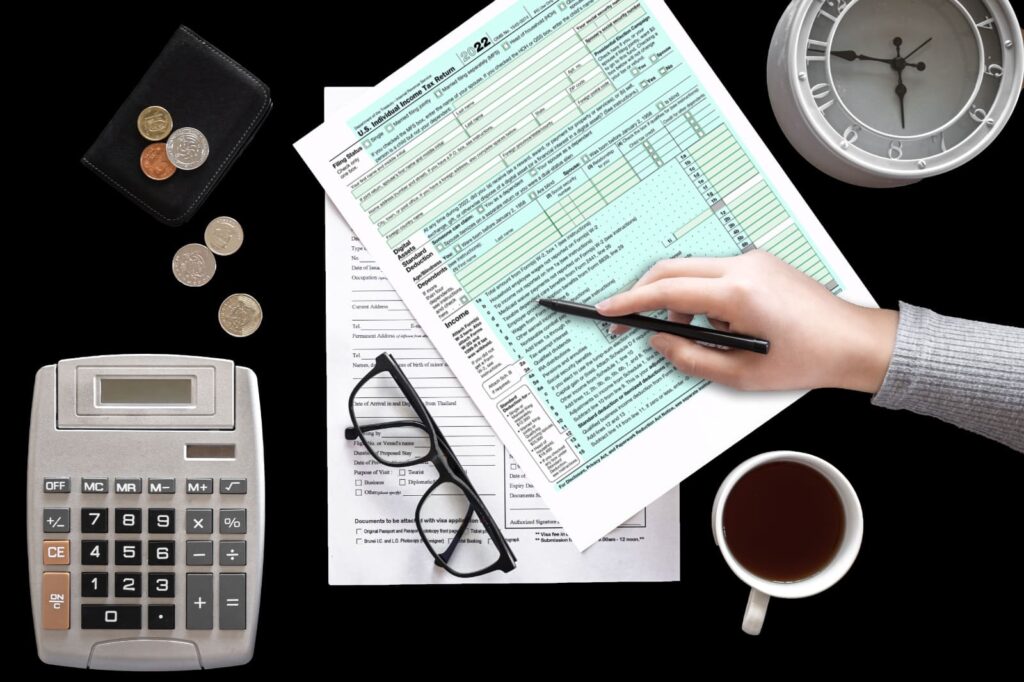

Tax Planning & Advisory

Globus Finanza’s Tax Planning & Advisory involves strategic management of financial affairs to optimize tax positions. Professionals analyze financial data, interpret tax laws, and devise tailored strategies to minimize tax liabilities while ensuring compliance.

This proactive approach includes advising on legal methods to reduce tax burdens, navigating regulatory changes, and offering insights to enhance overall financial efficiency.

Engaging in Tax Planning & Advisory ensures businesses make informed decisions, comply with tax regulations and maximize Financial Outcomes

Tax Liability Assessment

Evaluate current tax liabilities, analyzing financial data to identify potential savings and ensure businesses comply with relevant tax regulations when outsourcing tax planning and advisory services.

Transaction Structuring

Advise on tax-efficient structures for transactions, mergers, or acquisitions, ensuring businesses make informed decisions that align with their financial and strategic objectives when outsourcing advisory services.

Retirement Planning

Provide guidance on tax-efficient retirement planning strategies, ensuring individuals and businesses optimize benefits while complying with relevant tax regulations through outsourcing advisory services.

Tax Credit Utilization

Identify and leverage applicable tax credits, optimizing tax positions and reducing liabilities through proactive assessment and utilization of available credits within the outsourcing process.

Income and Expense Analysis

Analyze income and expenses comprehensively, identifying opportunities for deductions, exemptions, or credits to strategically manage tax implications when outsourcing tax planning and advisory functions.

Wealth Management

Advise on tax-efficient wealth management, optimizing asset allocation and inheritance strategies to minimize tax liabilities while adhering to legal compliance standards within the outsourcing framework.

Benefits of using our Tax Planning and Advisory Services

Access specialized tax professionals, ensuring accurate interpretation of tax laws and the development of optimal strategies for businesses and individuals through outsourced tax planning and advisory services.

Stay informed about changes in tax laws, adapting strategies promptly to remain compliant and optimize financial planning for businesses and individuals through outsourcing.

Stringent confidentiality measures secure sensitive financial data, maintaining client trust while complying with privacy standards in the context of tax planning and advisory services outsourcing.

Gain access to specialized support for intricate tax matters, ensuring businesses and individuals receive expert advice and guidance on complex tax scenarios through outsourcing services.

Tax Softwares we Use

Frequently Asked Questions

Tax planning helps individuals and businesses effectively manage their financial affairs to reduce tax liability and ensure compliance with tax laws. It can help maximize after-tax income, plan for future expenses, and achieve financial goals

We can provide expert advice on complex tax matters, help you identify opportunities for savings, assist in creating a customized tax plan tailored to your specific needs and goals, and ensure compliance with ever-changing tax regulations.

Tax laws are subject to change regularly; therefore, it is recommended to review your tax plan annually or whenever there are significant life changes (Marriage, Divorce, Birth of a child, Retirement, etc.) that may impact your tax situation.