Hey there! Let me guess – you’re spending way too many late nights trying to make sense of your business finances? Maybe you’ve got that famous “shoebox of receipts” sitting on your desk right now? Don’t worry, you’re not alone! Did you know most business owners spend about 15 hours every week (that’s two full workdays!) just dealing with bookkeeping tasks? But here’s the good news: outsourced bookkeeping services are changing the game for businesses just like yours.

Understanding Outsourced Bookkeeping Services: Your Financial Peace of Mind Team

Think of outsourced bookkeeping services as your personal financial dream team. Instead of struggling alone or paying a fortune for in-house staff, you get an entire crew of experts working behind the scenes to keep your finances in perfect shape. Pretty awesome, right?

Here’s what your dream team actually handles:

Daily Financial Management (The Everyday Stuff):

- Track every dollar coming in and going out

- Process and pay bills on time (no more late fees!)

- Keep tabs on customer payments

- Organize receipts digitally (goodbye, shoebox!)

- Reconcile bank accounts daily (catching any issues before they become problems)

Monthly Magic (The Big Picture Stuff):

- Create crystal-clear financial reports that actually make sense

- Show you exactly where your money’s going

- Help you understand if you’re hitting your business goals

- Give you a heads-up about potential cash flow issues

- Keep everything tax-ready (your accountant will love you!)

Why Smart Business Owners Choose Outsource Bookkeeping Services

Let’s talk about why this is such a brilliant move for your business. I’m going to break down the real numbers for you:

Traditional In-house Bookkeeping Costs:

- Full-time salary: $45,000-$55,000

- Benefits package: $15,000-$20,000

- Office space and equipment: $5,000-$8,000

- Software and training: $2,000-$5,000 Total: A whopping $67,000-$88,000 per year!

Outsourced Bookkeeping Service Costs:

- Basic package: $24,000-$36,000/year

- Premium package: $36,000-$48,000/year

- Custom solutions: Based on your needs

That’s like getting a 50% discount on your bookkeeping! Plus, you’re getting way more value:

- Expert team instead of just one person

- No vacation or sick day coverage needed

- Access to advanced technology without extra costs

- Scalable service that grows with your business

- Peace of mind knowing experts are handling your books

The Technology Magic Behind Modern Outsourced Bookkeeping Service

Here’s where things get really cool. Modern bookkeeping services use amazing technology that makes everything super smooth and secure:

Bank-Level Security:

- 256-bit encryption (the same stuff banks use)

- Super secure passwords and authentication

- Regular security checks and updates

- Safe and secure client portals

- Automatic backups of everything

Real-Time Access:

- Check your numbers anytime, anywhere

- User-friendly mobile apps

- Easy-to-read dashboards

- Instant report generation

- Quick answers to your questions

Smart Integrations:

- Works with QuickBooks, Xero, and other popular software

- Connects with your bank accounts

- Links to your payment systems

- Integrates with your business tools

- Everything talks to each other automatically

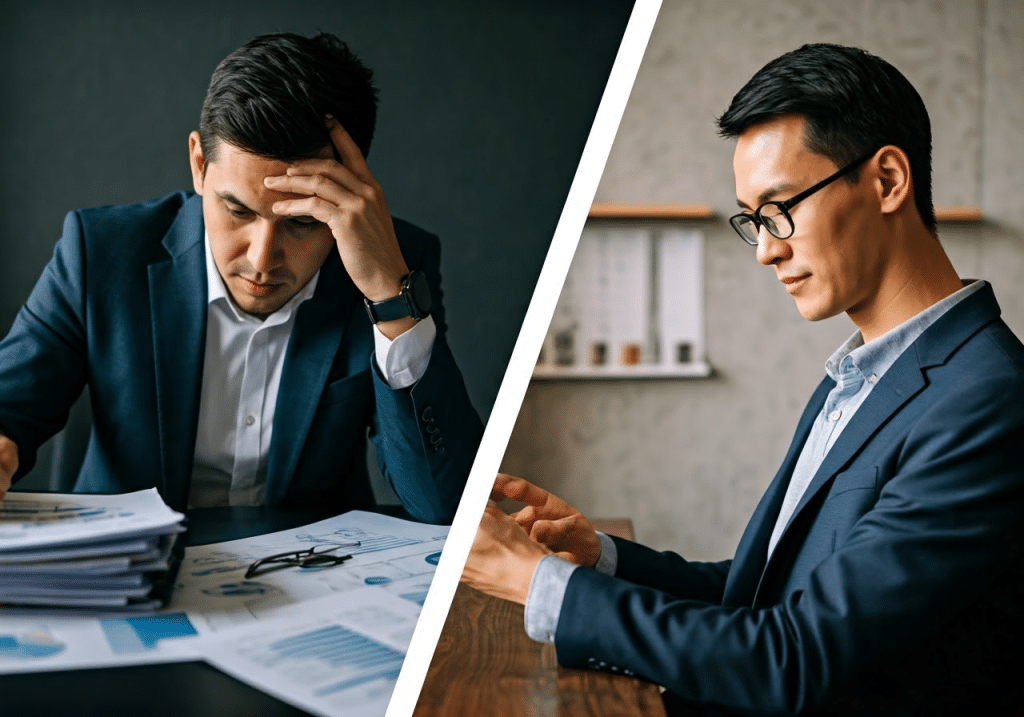

How Outsourcing Bookkeeping Services Transforms Your Business Life

Let me paint you a picture of how life changes with outsourced bookkeeping:

Before Outsourcing:

- Spending weekends catching up on bookkeeping

- Stressing about tax season

- Missing out on family time

- Wondering if your numbers are accurate

- Playing catch-up with late invoices

After Outsourcing:

- Checking quick, accurate reports over morning coffee

- Having clear insights for business decisions

- Spending weekends with family

- Feeling confident about your finances

- Growing your business instead of doing data entry

Real Time Savings:

- 15-20 hours saved every week

- Month-end closing in 3-4 days instead of 10-12

- Tax prep time cut in half

- Instant access to financial info when you need it

Making the Most of Your Outsourced Bookkeeping Service Partnership

Want to get the absolute best results? Here’s how to rock your outsourcing relationship:

Communication Done Right:

- Set up regular check-ins that work for your schedule

- Use simple tools to stay in touch

- Get updates the way you prefer (email, chat, phone)

- Have a real person to talk to when you need help

Smart Document Management:

- Use easy phone apps to scan receipts

- Set up simple approval processes

- Keep digital copies of everything

- Access any document in seconds

Performance Tracking:

- Regular updates on your business health

- Easy-to-understand progress reports

- Clear communication about any issues

- Constant optimization of processes

Take Action Today (It’s Super Easy!)

Ready to transform your business finances? Here’s how to get started:

- Schedule a Free Chat Let’s talk about your business and what you need. No pressure, just a friendly conversation about how we can help.

- Get a Custom Plan We’ll create a perfect solution for your business size and needs.

- Easy Setup We handle all the technical stuff and make the transition smooth and simple.

- Enjoy Peace of Mind Finally focus on growing your business while we handle the numbers!

Globus Finanza: “Let’s Make Bookkeeping Easy – Schedule a Meeting!”

- Inquiry: +1 302 532 9025

- Email: connect@globusfinanza.com

- Website: https://globusfinanza.com/

- Address: 600 N Broad Street, Suite 5 #665, Middle Town, Delaware 19709, United States

FAQs

How Much Do Outsourced Bookkeeping Services Actually Cost?

The cost of outsourced bookkeeping services typically ranges from $500 to $2,500 per month for small to medium businesses. The exact price depends on your transaction volume, complexity, and service level needed. Basic bookkeeping packages start around $500-800 monthly, while comprehensive services including advanced financial reporting and CFO advisory services can range from $1,500-2,500 monthly. Compared to an in-house bookkeeper’s total cost (salary + benefits) of $5,000-7,000 monthly, outsourcing can save businesses 40-60% on their bookkeeping expenses.

Is It Safe to Share Financial Data with Outsourced Bookkeeping Services?

Modern outsourced bookkeeping services use bank-level security measures to protect your financial data. This includes 256-bit encryption (the same used by major banks), multi-factor authentication, secure client portals, and regular security audits. Most reputable services also sign comprehensive NDAs and have cyber liability insurance. Additionally, they use secure cloud storage with automatic backups and maintain detailed access logs of who views your financial information.

Can Outsourced Bookkeeping Services Handle My Industry-Specific Needs?

Yes! Today’s outsourced bookkeeping services typically have teams specialized in various industries. They understand specific requirements for retail inventory tracking, construction job costing, healthcare billing compliance, manufacturing cost accounting, and non-profit fund accounting. The best providers will assign you team members who have experience in your industry and understand its unique challenges and regulations.

How Long Does It Take to Transition to Outsourced Bookkeeping Services?

The typical transition takes 2-4 weeks, depending on your business size and complexity. Here’s a general timeline: Week 1: Initial setup and system integration Week 2: Data migration and account reconciliation Week 3: Process testing and team training Week 4: Fine-tuning and full implementation

Most providers handle the entire transition process, ensuring minimal disruption to your business operations.

What’s the Difference Between Traditional Bookkeeping and Modern Outsourced Bookkeeping Services?

Modern outsourced bookkeeping services offer significant advantages over traditional methods. While traditional bookkeeping focuses mainly on data entry and basic reconciliation, outsourced services provide real-time financial insights, automated processes, and proactive financial planning. They use AI-powered tools for accuracy, integrate with multiple business systems, and offer 24/7 access to your financial data through secure cloud platforms. Plus, you get a team of experts instead of relying on a single bookkeeper, ensuring continuous coverage and diverse expertise.